Bank Transfer

| A/C | Dev Bhoomi Samiti |

| Bank Name | Punjab National Bank (PNB) |

| IFSC Code | IFSC-PUNB0000210 |

| Account Number | 00022612000124 |

| Branch | Rajpur Road Dehradun |

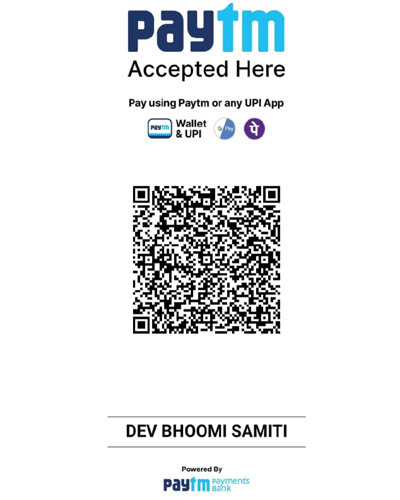

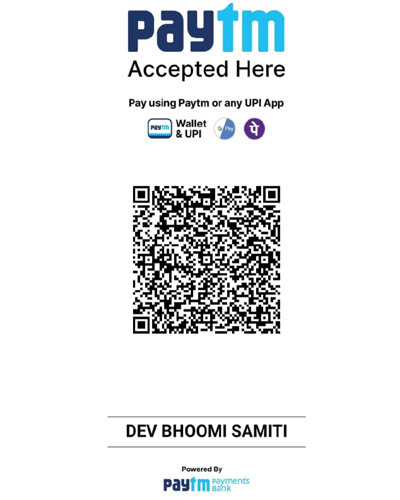

Paytm/UPI: Dev Bhoomi Samiti

Home / Donation

| A/C | Dev Bhoomi Samiti |

| Bank Name | Punjab National Bank (PNB) |

| IFSC Code | IFSC-PUNB0000210 |

| Account Number | 00022612000124 |

| Branch | Rajpur Road Dehradun |

Income Tax Exemption in India: How does it work?

Tax exemption is the financial exclusion that lowers the taxable income,therefore a mandatory exemption to a general rule. Tax exemptions are given to boost certain economic activities such as the activities of the Charity Organization

What is Legal Status of Dev Bhoomi Samiti In Income Tax Act,1961?

Dev Bhoomi Samiti is a registred trust under section 12 AA of Income Tax Act 1961. The income is calculated according to Section 11.

What Section 80G of Income Tax Act says?

Minimum Donation: No such Requirement

Eligible Person: Every person whose income is taxable under Income Tax Act,1961

Under this section 50% of your donation to our fund shall qualify for exemption from income tax. Moreover, the qualifying amount must not exceed 10% of your gross income.

Is the Donation given to Devbhoomi Samiti, eligible for tax benefit ?

Yes, 80G is a certificate that exempts you from paying taxes if you have made donations to NGOs, charitable trusts that are registered to offer you exemptions from taxes. Donations to Dev Bhoomi Samiti are exempt from 50% tax under section 80G of the Income Tax Act. The tax benefit is valid only in India.

What Tax exemption benefit do I get?

Making donations under section 80G can help you with tax deduction benefits. The exemption is calculated by reducing the donated amount from your taxable salary. For instance, if your taxable income per year is Rs 200,000 and you make a donation of Rs 5,000 then your net taxable income will become Rs 197,500. Your tax will now be calculated on this new amount basis the prevailing tax rates. As per the revised tax exemption act, effective April 1, 2017, donations to Dev Bhoomi Samiti will be eligible for a 50% tax exemption under Section 80G of Income Tax Act.

When can I get a tax exemption certificate?

We generate the tax certificate within 8 days from the date of the contribution made through online donations. Including the courier process, it takes 10 days for the exemption certificate to reach you. If you contribute offline it takes 15 to 20 days.

What is the minimum amount that needs to be donated to get a tax exemption?

A minimum of Rs 500 needs to be donated to avail tax exemption under IT sec 80 G for Online Donations.

Do you issue instant tax receipts?

Soft Copy Receipt of the donation is made available instantly. But, Hard Copy of your tax receipts can be provided within 10 days.

Are there tax exemptions on cash donations as well?

Cash donations above Rs.2, 000 are not applicable for 80G certificates.

What is Foreign Contribution Regulation Act (FCRA)

The Foreign Contribution Regulation Act (FCRA) is the overarching law that monitors and manages all the foreign contributions coming to India. Foreign contribution essentially means donations or transfers made by a foreign source like an individual, a corporate or an organization. The official website of the Ministry of Home Affairs has a detailed section dedicated to FCRA

Is Dev Bhoomi Samiti registered under Foreign Contribution Regulation Act (FCRA)?

Yes, Dev Bhoomi Samiti is registered under Section 6(1) of Foreign Contribution Regulation Act, 2010.

Who is considered as foreign corporate of individual?

Foreign source, as per the Foreign Contribution Regulation Act (FCRA), may be:

Hence, if you are under any of these designations, you will be considered under the FCRA regulations. Consequently the NGO to which you wish to contribute must be FCRA compliant, such as Dev Bhoomi Samiti

Can this NGO guarantees to provide financial transparency whenever requried it?

Yes, Dev Bhoomi Samiti has been committed to the highest standards of transparency. We are fully compliant with the FCRA regulations and our accounts are monitored by qualified internal and external auditors. We are therefore authorized to receive foreign donations and we prepare detailed reports whenever required

Designed & Developed By ADXVENTURE